Kenya is seeking to use part of the proceeds of the World Banks’s $1 billion loan to settle the outstanding $500 million of the debut 10-year bond that is maturing in June 24, amid declining forex reserves, falling domestic revenue collections and surging expenditures including debt repayment costs.

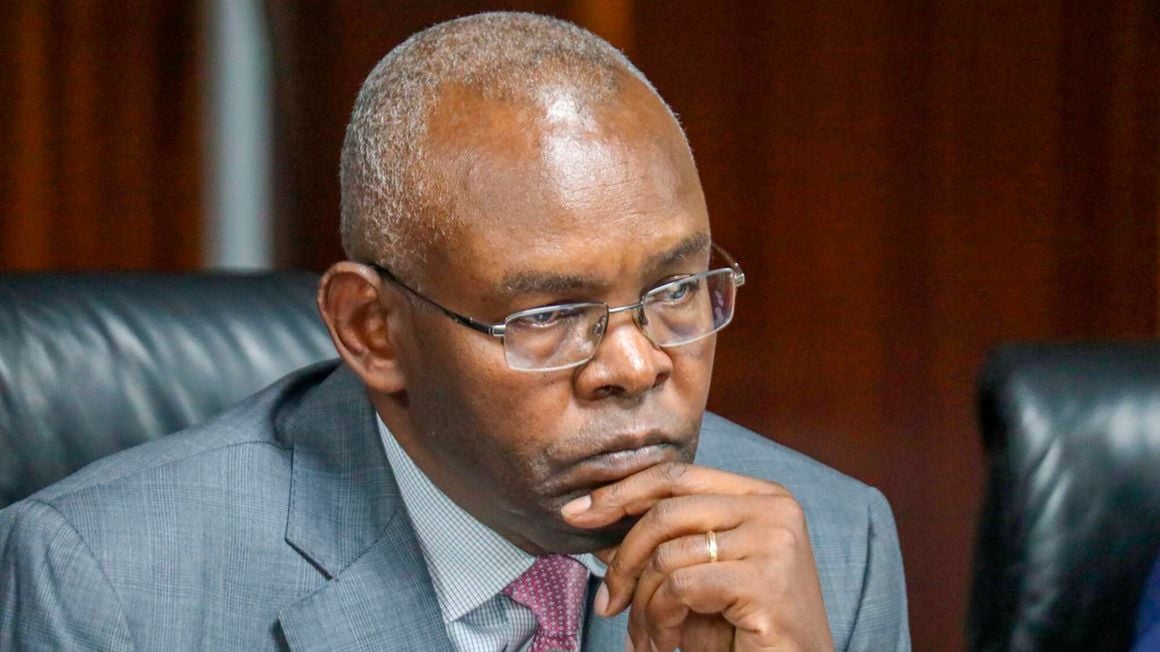

Central Bank of Kenya (CBK) Governor Kamau Thugge told The EastAfrican that the expected disbursement from the World Bank related to the Development Policy Operations (DPO) will be used to pay off the $500 million final instalment of the $2 billion bond that was issued in 2014.

“The World Bank disbursement related to the DPO will be used for that purpose,” Dr Thugge said.

The World Bank Group board of directors in May 2023 approved a DPO for $1 billion to provide low-cost budget financing along with support to key policy and institutional reforms for Kenya’s near-term objectives of fiscal consolidation as well as long term goal of green and inclusive growth.

The first set of reforms revolves around creation of fiscal space in a sustainable and equitable manner, including revenue and expenditure measures to support fiscal consolidation, while the second set of reforms involves improving competitiveness to boost agricultural exports.

The third wave of reforms require strengthening of transparency and accountability to improve governance and financial inclusion for the private sector.

In February this year, Dr Thugge said the country was expecting disbursement from the World Bank of about $1.5 billion around March and April.

The National Treasury issued a $1.5 billion Eurobond that was priced expensively to global investors to be able to make partial repayment of the bond and allay fears of the possibility of default.

On the new seven-year bond, the government will pay interest at an annual rate of 9.75 percent compared to a rate of 6.875 percent on the maturing 2014 issue.

Kenya’s foreign currency reserves have fallen by 1.1 percent in over a month to $7.14 billion (equivalent to 3.8 months of import cover) during the week ended April 5 from $7.22 billion (3.9 months of import cover) in the week ended February 22, according to Central Bank data.

This compares unfavourably with CBK’s statutory threshold of maintaining forex reserves of at least four months of import cover and EAC convergence threshold of at least 4.5 months of import cover.

The Parliamentary budget Office said Kenya is still in debt distress despite the $1.5 billion Eurobond issues that helped to calm foreign investor jitters over the possibility of the country defaulting on the repayment of its debut $2 billion Eurobond that is maturing in June.

The PBO said the economy is still in danger of a liquidity crisis with its key debt sustainability indicators, including debt service-to-revenue ratio and debt-to-gross domestic product (GDP) headed south.

This is amid falling revenue collections and surging debt repayment costs.

“Moreover, a significant risk of debt distress persists, primarily arising from liquidity risks, while debt dynamics remain susceptible to fluctuations in exports, exchange rates, fiscal conditions, and natural disasters,” according to PBO.

“Moreover, the escalating cost of debt poses a substantial challenge for the repayment of both external and domestic obligations. As the repayment burden increases the country faces potential funding constraints, emphasizing the need for strategic measures to mitigate these challenges and ensure sustainable financial stability.”

In October 2023, the Parliament passed an amendment to the Public Finance Management (PFM) law, replacing the Ksh10 trillion ($76.92 billion) public debt numerical ceiling with a debt anchor set at 55 percent of GDP in present value terms that are expected to be achieved by 2029.

Kenya has raised a total of $9.35 billion through Eurobond issues in the past 10 years which are listed on both Irish Stock Exchange (ISE) and the London Stock Exchange (LSE).

In 2014, Kenya issued a $2 billion Eurobond and tapped for a further $ 750 million, while the second Eurobond of $2 billion was issued in February (2018).

In May 2019 Kenya raised $2.1 billion from the international capital markets to pay off other loans including a $750 million Eurobond that matured on June 24, 2019, and other debt obligations.

The bond was issued in two tranches of 7-year tenor and 12-year tenor priced at 7 percent and 8 percent respectively.

In June 2021 Kenya raised an additional $1 billion Kenya by issuing a 12-year Eurobond at 6.3 percent.

In June 2022 National Treasury cancelled the issuance of the $1 billion Eurobond over high financing costs concerns after receiving bids priced at 12 percent while in February 2024 the National Treasury issued another $1.5 billion Eurobond to pay off part of the $2 billion Eurobond maturing in June this year (2024).